Common financial wisdom recommends that you diversify your investments. This typically means that you have a combination of stocks and bonds, the proportion of your portfolio in each depends on the risk you want to take and the returns you expect. The more money you have in stocks the higher your returns and the higher your risk and the more money in bonds, the lower your returns and the lower your risk. So goes the common wisdom.

What’s wrong with this approach? Although the above statement about stocks and bonds and the associated risk reward balance is generally true, there is more to investment diversification and risk reward management than this.

Whether you are aware of it or not, every investment strategy is based on an underlying assumption. The key to successful diversification is to utilize different strategies that are based on different assumptions. Let’s look at this in a little bit more detail.

Investing in Stocks

Common financial wisdom recommends a buy and hold approach for stocks.

When you buy shares in a corporation, you are assuming that that company is going to grow over time. In particular, you want that company to make more money over time so that its earnings per share increase. This typically drives the share price up so your investment also rises.

When the underlying assumption is not met, then the strategy will most likely fail. If the company runs into trouble, does not meet its sales and revenue expectations and performs poorly, then its share prices will likely go down and your investment will loose value with them. In the worst case scenario, if the company goes bankrupt and fails miserably, then your investment will also fail miserably.

To minimize this risk, common financial wisdom suggests you spread out your investment over many companies. You can achieve this by buying shares of several companies or simply by investing in a fund such as an ETF or a mutual fund. When you invest in a fund you are averaging out the performance of the individual companies within the fund. This way you are less subject to the highs and lows of a particular corporation.

Taking this logic a step or two further, common financial wisdom suggests that you diversify even more by having money in funds covering different sectors of the economy. And, so as not to put all your faith in the US economy, common financial wisdom says that you diversify even more by adding some funds that offer exposure to markets outside the USA such as Europe, Japan and the developing economies of nations such as Brazil, Russia, India and China or BRIC for short.

What has this common financial wisdom process done for you? By changing your holdings from a handful of individual corporations to a group of global funds, you have shifted the forces effecting your portfolio from those effecting a singular corporation to global macro economic ones.

Although you have diversified your holdings, your underlying assumption has not changed. You still have a buy and hold approach for all your investments and you still require growth for your investments to make money. Whether it’s corporate growth or economic growth, your entire investment portfolio is still relying one one assumption.

Investing in Bonds

Because stock markets can be so volatile, common financial wisdom suggests that you allocate a portion of your portfolio to bonds. These include instruments such as corporate bonds, government bonds, municipal bonds and other debt securities like mortgage-backed securities.

If the focus on stocks is on capital appreciation, or the increase in the price of the asset, the focus in bonds is on income generation or the interest payments you receive for lending your money to a third party. When you invest in bonds you are trading the potential for a higher return on your investment through capital appreciation for a more reliable income stream.

Common financial wisdom suggests a similar diversification process for bonds as they do for stocks. As described above for stocks, you can go from owning individual bonds all the way to various global bond funds.

The problem with stocks and bonds

First, let’s have a look at stocks or ETFs. Whether you are invested in a few hand picked blue chip stocks or several funds covering the global economy, there are a couple of risks inherent to the buy and hold approach.

- Prices tend to go up slowly and come down much faster. For example, looking at the last few up and down movements of the S&P 500 we see the following:

| Date | Low | High | Years | |

| 09-12-1996 | $671.15 | |||

| 03-24-2000 | $1527,46 | 3.53 | Up | |

| 10-09-2002 | $776.76 | 2.55 | Down | |

| 10-09-2007 | $1565.15 | 5.00 | Up | |

| 03-09-2009 | $676.53 | 1.42 | Down | |

| 03-14-2013 | $1563.23 | 4.02 | Up |

The above table also shows that in 2009 the market was almost at the same price as it was in 1996, $676.53 compared to $671.15. In about 1.42 years the market lost all the gains that it had gained over the past 11 years or so. This illustrates the risk inherent to investing in a stock fund.

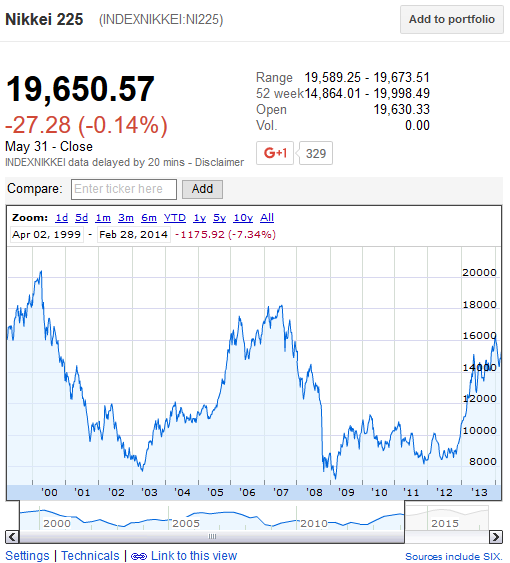

2. Diversifying by investing into different market sectors and different country funds does not protect you from the losses described in 1. The above numbers are for the S&P 500 index which covers all sectors of the US market. When it lost 11 years of value in 2008 and 2009, so did other markets across the world as illustrated below.

Second, let’s have a look at bonds. Although bonds are in general less volatile than stocks, it doesn’t mean there is no risk involved.

- Unless you purchase individual bonds and hold them to maturity you have no way of eliminating bond price risk in your investment. Bond prices are going to go up and down just like stock prices do and this movement will offset any monies you make on the interest received.

Price Chart showing the variation in fund price with time. Note also the yield of 1.75% compared to a price movement of more than 10%. Chart image courtesy of Google Finance. 2. Although bonds are considered as lower risk they are not risk free. Even government bonds which historically have been considered safer than corporate issues are not a slam dunk. With government debts getting bigger and bigger the risk of default is there. From Greece to Russia to Argentina to Detroit to Orange County to Puerto Rico, government money problems are a reality.

An Alternative to Stocks and Bonds.

If you’re invested in a stock fund, buy and hold requires corporate growth and economic growth for your investment in the fund to make money. When the economy slows down or hits a recession your investment is going to run into trouble. On the other hand, if you are invested in a bond fund, bond prices are going to go down as interest rates rise. This drop in price will offset the dividend payments that the bond fund had generated for you.

Typically interest rates rise as the economy strengthens and stock markets rise. Similarly interest rates come down and bond prices rise as the economy contracts and stock markets fall. Thus you can offset some of your stock losses with bonds and bond losses with stocks. However this diversification is not nearly enough to eliminate significant drawdowns to your portfolio that hinder its growth.

Furthermore, you can get caught up in the cycle of perpetually trying to guess where the market is going in an attempt to optimize your stock bond allocation accordingly. As discussed in the post Investing Driven By Science, even the brightest financial minds on Wall St have a hard time predicting the future.

In my opinion, the best way to truly hedge against all market conditions is to include strategies in your portfolio that do not rely on the same growth and contraction assumptions as stocks and bonds do. This way you are truly diversified and your portfolio can continue to grow no matter what the market conditions are.