It is relatively easy to find an investment strategy that performs well in one kind of market but it is hard to find a strategy that performs well in all types of markets. For example, when I started looking at managing my own monies, I started buying undervalued stocks following the principles of value investing made famous by Warren Buffett and his mentors Benjamin Graham and David Dodd. This was 2009, right at the end of the great recession. My timing was right and pretty much every investment I made was a home run, up 100% or more within a few months.

Was I onto something special? Did I have a winning strategy? The answer to these questions turned out to be a strong No as 2011 and 2012 came around and I found out the hard way that the party was over. As it turns out, one or two years of good results can be just due to luck. One needs to test the strategy over different types of markets to get a better picture of what reality might look like.

Different Types of Markets

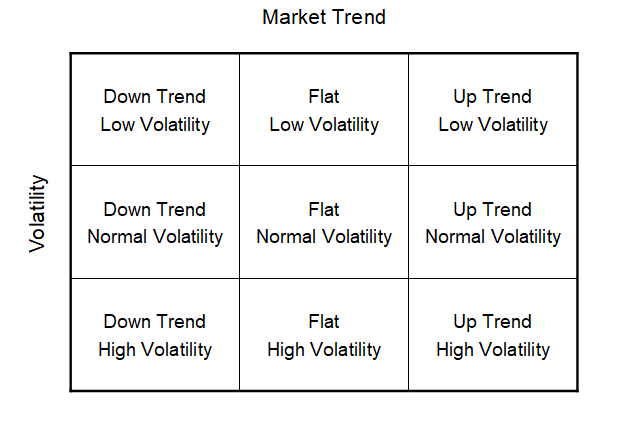

When looking at characterizing market conditions one must think of volatility as well as market direction. This gives a combination of 9 different market types as characterized by the table below:

Looking at the above table it is easier to understand why some strategies are doomed to fail from the start. For example, if one develops a momentum or trend following strategy that does really well in a quiet bull market as characterized by a strong up trend and low volatility, when the volatility picks up or the trend direction changes, the strategy will loose money.

This leads us to an important observation and guiding principle. If you find yourself hoping that the market is going to change then it’s probably time that you start looking for another strategy. The market is going to do what the market is going to do. It is up to you take control of your investments by choosing different strategies for different market conditions.

So next time you find yourself worrying what’s going to happen to your investments when the next recession hits or how long this bull market is going to last, try and remember that the answer is another question. A better question. What strategies do I need to add to my portfolio so that I can make money in all market conditions?