Investment returns, along with risk management, are by far the most important aspect of any investment. Yet they are the least talked about.

If you do a quick search of current financial literature you will find a lot of talk and material about the importance of savings on a consistent basis, avoiding higher fees, the power of compounding, dollar cost averaging and the like. Yet few articles focus on the most important factor of all, the annual rate of return of your investments. Typically this is assumed to range anywhere from 5% to 10% per year depending on whether you invest in bonds or stocks.

Although all the topics mentioned above are an important consideration to your investment, none have as big an effect as the annual rate of return.

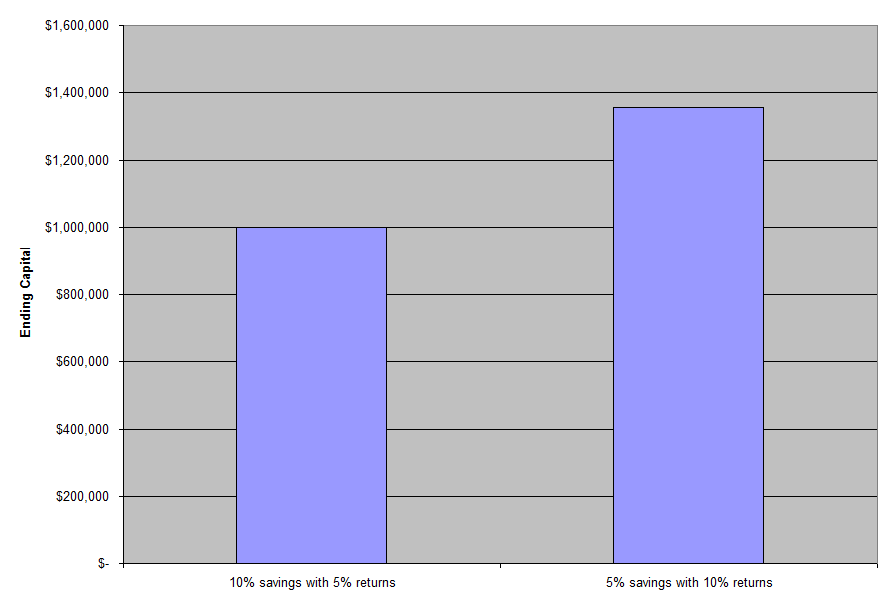

For example, say you make $120,000 per year. If you were to invest 10% of your salary on a monthly basis and make 5% annual return on your investment after 30 years you would end up with $998,710.31. On the other hand if you just invested 5% of your salary on a monthly basis and made 10% annual interest on your investment after 30 years you would end up with $1,356,293.07.

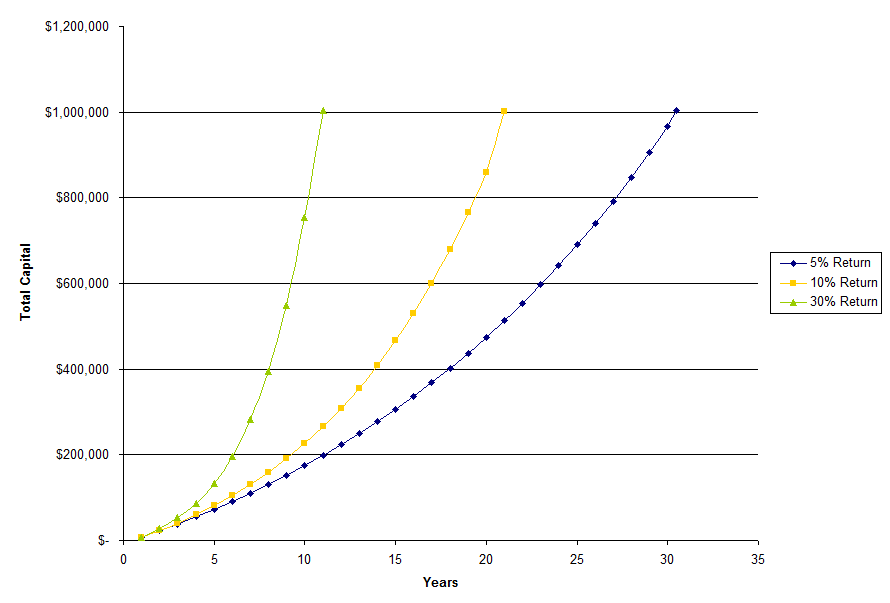

As another example, say you make $120,000 per year and you invest 10% of your income on a monthly basis. At a 5% rate of return, after 10 years you would have $186,338.70. On the other hand at a 10% rate of return, after 10 years you would have $245,813.89. At a 20% rate of return, after 10 years you would have $451,314.51.

Finally, let’s look at this another way. Say you are willing to save $1,200 per month until you have a million dollars. At a 5% rate of return, it is going to take you 30.1 years to achieve your goal. At a 10% rate of return, it will take you 20.8 years. With a 30% rate of return you can be a millionaire in just 10.4 years.

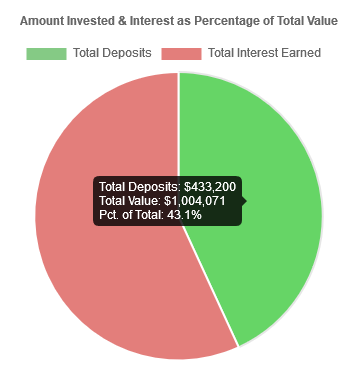

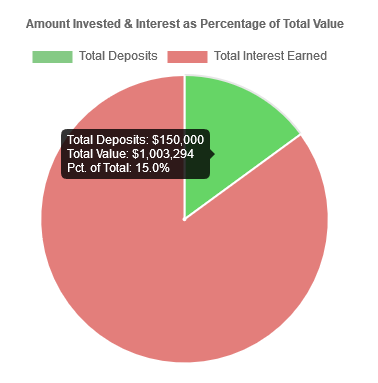

The rates of return also have an effect on the amount of money you have to put in compared to the amount of money that you earn. The higher the rate of return, the less money you have to save and the more money you earn through your investment.

These examples illustrate the importance of the rate of return on an investment. All examples were computed using the Financial Calculators found on this website. You can play around with the numbers and see how the rate of return effects you personally.

The failure to focus the conversation on investment returns may be due to the fact that the investment strategy of choice, buy and hold of bonds and stock products such as ETFs and Mutual Funds, does not offer the possibility for higher returns. Most financial professionals have no financial incentive to advise their clients of alternative investments. Even more so, most financial professionals don’t have access to alternative investments or are not even aware of their existence. As such they only offer the standard products or variations thereof.