The Quantopolis Pullback Portfolio (previously called the Quantopolis E-Mini Portfolio) combines the TF Pullback, ES Pullback and NQ Pullback II strategies into one portfolio. Individual strategy parameters have been selected such that in most market environments entries and exits are staggered. Thus the portfolio can improve performance while minimizing overall risk.

The amount of capital allocated to each strategy is as described in the summary description for each strategy and totals $54,175.

As of 2020, the strategy can also be traded using the micro E-Mini contracts. These contracts are 1/10 of the size of the regular E-Mini contracts. Thus the historical capital requirement for the Quantopolis Micro Pullback Portfolio would have been $5,418.

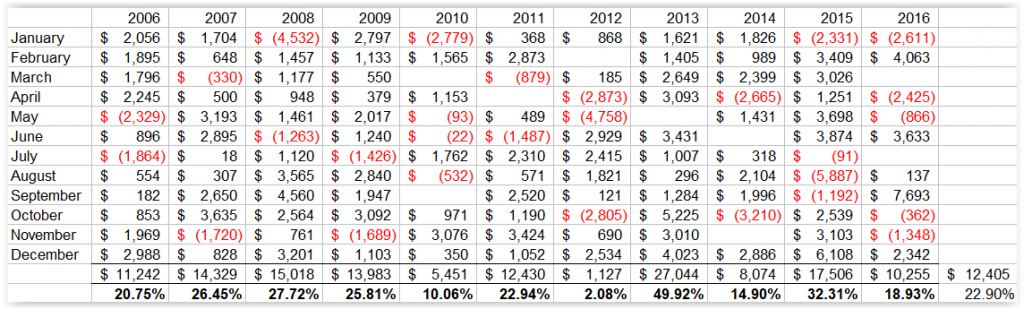

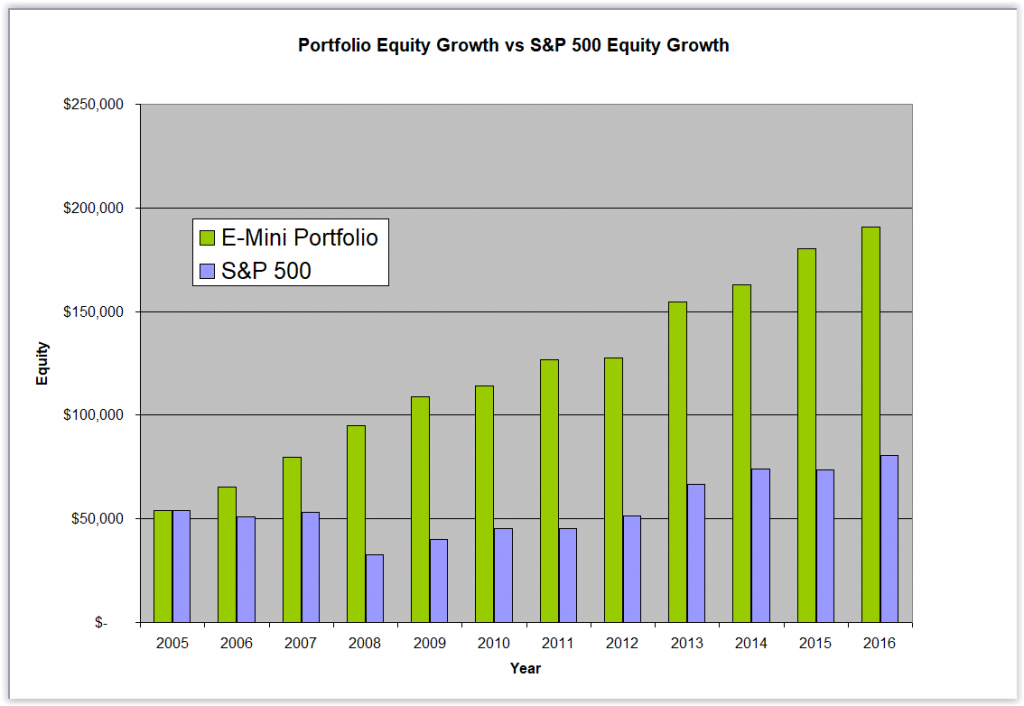

Backtesting was done from 2006 to 2016 as this is the period where data was available for all the strategies. During this period the Quantopolis Pullback Portfolio had a net average annual return of 22.90% with a maximum drawdown of -19.06% of the allocated capital of $54,175. This translates to a risk reward ratio of 1.02

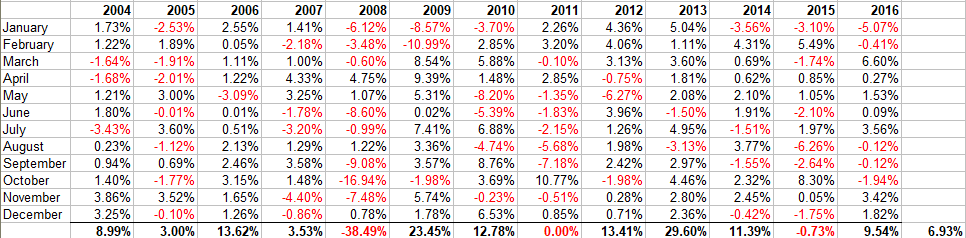

In contrast, from 2004 to 2016, using a buy and hold strategy on the S&P 500 index as the benchmark, we get an average annual return of 6.93% with a maximum drawdown of -56.78% for a risk reward ratio of 0.12. During this 13 year period the S&P 500 had 63% up months and three down years.

Thus, if we use the Risk Reward factor to compare the portfolio performance with a buy and hold approach in the S&P 500, we can see that the Quantopolis Pullback Portfolio did about 9 times better. In particular, by combining three strategies into one portfolio we get a higher risk reward ratio than when trading each one of the constituent strategies as a stand alone. This is the power of true diversification which employs different strategies with different assumptions.

It is worth noting that in the above discussion, the monies generated from the Quantopolis Pullback Portfolio strategies were not re-invested in the system. On the other hand, by its nature, a buy and hold approach automatically re-invests any monies that are generated.

Thus one could potentially increase the returns of the Quantopolis Pullback Portfolio by re-investing some of the monies generated. That said, investing in the Futures Markets requires different considerations than investing in a stock or an ETF. For a more complete discussion between the two approaches, including risk considerations and money management, please read our posts Investing in the Futures Markets and Compounding With Futures