In the post Buyer Beware I listed what I think are the main reasons why quantitative systems fail and why investors are right to be leery about investing in a black box system. That said, it is possible to make money with a quantitative approach if one can identify a good system to follow. This involves researching the system and the vendor, the broker and then making the right choice. We’ll have a look at these three steps in the next three paragraphs.

The Characteristics of a Good Investment Strategy

From 2011 onward I have been using quantified investment systems to manage my portfolio. These have allowed me to manage my downside while going for superior returns. Since then, I have looked into and personally backtested a great number of trading systems and have come to the conclusion that good trading systems have the following characteristics:

- The underlying market assumptions on which the strategy is built must be well understood. These are the key driving factors of the system and if they change the system is most likely no longer viable.

- They must have well defined black and white rules that are free from subjectivity and that can be followed and replicated. If different people using the strategy do different things or if the same person does different things at different times then this is not a well defined strategy.

- They have a good risk to reward ratio. It is not sufficient that they have good year to year returns, but their maximum historical drawdowns must be acceptable. The higher the ratio of their average annual return to the maximum historical drawdown the better.

- They must show consistent results from year to year. I want to have a strategy whose returns are spread out as evenly as possible from year to year. A strategy that has huge returns in one or two years and little returns or losses on the other years is dangerous as it might indicate a market bias.

- They must have shown good backtesting results over different market conditions. This typically means a backtesting period of 10 years or more that includes a strong up market, a strong down market, a low volatility market, a high volatility market and all combinations thereof.

- The backtesting must be solid and free from common errors such as survivorship bias, look-ahead bias and implementation errors. Strategies that do not include delisted securities or the effects of slippage and commissions in their backtesting might be good theoretical studies but are useless in practice.

- They have live results verified by an independent third party. This is the way I can know for sure that the developer or the vendor of the strategy is for real.

- The vendor or developer of the strategy has his or her own monies invested in the strategy. If the strategy is as good as described, then the vendor should have no problem putting his money where his mouth is.

- Whenever, you are looking into a vendor, make sure that you look into how many strategies they have published and how they are all doing. There is nothing wrong with a vendor offering more than one strategy and all strategies can have a bad year or two. However if a lot of strategies offered by a vendor are in the red it is highly likely that the vendor is going for the Shotgun Approach.

- The developer should be readily available to answer questions about the strategy. If it’s not easy to get a hold of the developer, I would stay away from that strategy.

- If available, check the historical records. This is particularly helpful to uncover the Shotgun Approach and the Bait and Switch discussed in Buyer Beware. If a year ago a vendor showed some top performing strategies and today they are all losers, you know that most likely their current winners are going to face the same dire fate.

The Broker And You

It is very important to know that the broker’s business model is very different than yours. Although you need to find a good strategy to make money, the broker’s main source of income is through the fees charged such as commissions and subscription fees. Although a broker that offers good strategies will attract and retain more clients, unlike yourself, they are not going to loose a lot of capital if one or more strategies under perform.

Thus it is your responsibility to do your due diligence as described above and eliminate all the strategies that don’t fit your criteria. In particular you have to discriminate against strategies with a short history and those with low risk to reward ratios. In addition stay away from vendors with multiple strategies looking for a shotgun approach as described in Buyer Beware.

Once you’ve identified a strategy you like, look up the vendor and do more research online about the system. Due to liability reasons brokers are limited in the amount of information they can provide about a trading system or developer. So see if the developer has a website that describes his strategies and approach in more detail.

The Lucky Ones

Let’s assume that you went through all the criteria described above and you’ve identified one or more systems that are worth investing your hard earned monies into. One common mistake a lot of investors make is that they tend to favor and want to invest or put more monies in the system that has been doing well in the short term. This is very tempting because unfortunately brokers like to feature the most recent top performing strategies very prominently on their websites. I call these strategies the lucky ones.

Just as was highlighted in the Needle In The Haystack paragraph of Buyer Beware, three months to two years of good performance does not mean much. One should thus consider the Risk Reward ratio of the strategy over its entire history and use that as a guideline in making decisions about capital allocation.

Choosing to consider only the recent performance has the implicit assumption that the market is going to be the same going forward as in the recent past. However, without making any guesses about the economic forces driving the market, from a statistical perspective it is more likely that the market over the next year or so is going to be similar in nature to one of the years over the past ten years as opposed to exactly the past year. This is similar to saying that, all other assumptions aside, if you walk in a room of 100 random people your are more likely to find somebody who shares more of your interests than if you walk in a room of just 5 random people.

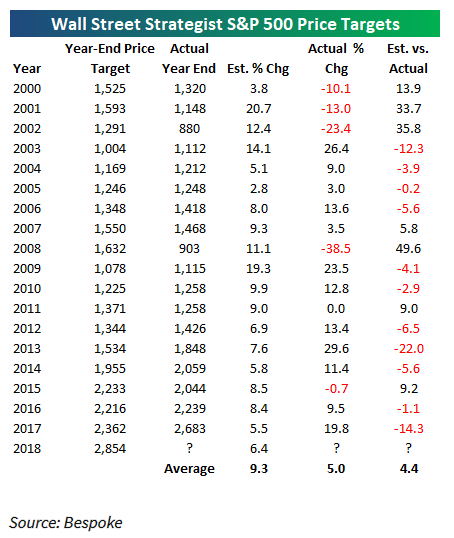

As the following picture illustrates, even the best strategists on wall street can never guess what the market is going to do next year. So don’t try. Choose a statistical approach instead.

Investing Success

If one finds a strategy that meets the above characteristics and sticks with it, then one has the odds stacked in his or her favor and he or she is setting themselves up for success.